5 Things Every CPA Should Know About Artificial Intelligence

Recently, I was interviewed on a CPA Ontario podcast to discuss the topic of Demystifying AI. We discussed a range of topics on the subject to help CPAs separate fact from fiction.

What are 5 things that CPAs should know about this technology? Read on!

#1 Do not overestimate the ability of AI or other technologies

At the end of the day, AI is a tool - just like a hammer. It's built by human beings and so they are not perfect and have issues. We must resist the temptation to overestimate the capabilities of tech. Even in my days as an IT auditor, when assessing the reliance on a report generated by a system; people tended to believe that the report is right just because it generated by a piece of technology.

Fast forward to AI: it's the same issue today.

In the epic battle between man versus machine, the chess champion Gary Kasparov threw the match because it is alleged that he thought that the AI-powered system did a well-calculated move. In reality, it was just a random move that the system threw out because it had experienced a technical glitch.

AI is not a magical creature. Rather, going back to the hammer, it is a tool that helps us analyze data.

Today, we use spreadsheet formulas, visualization tools like Tableau, or audit data analytics software to extract the insights we need from the data we are analyzing. But AI takes up a notch. Consider something like IBM’s Watson. Its ability to process language enabled it to defeat the two reigning Jeopardy! champs at the time Brad Rutter and Ken Jennings.

#2 Science fiction distorts our understanding of AI

I delivered a talk on exponential technologies a few years ago. The first question I got from the audience was whether that we can expect a science-fiction-like future with robots running the world like we have seen in the Terminator or the Matrix.

In other words, people expect "strong AI", i.e. a robot that can do almost anything, but what they get is weak AI. Weak AI is where the AI is applied to a specific domain and targets a specific problem. IBM started training Watson in 2007, so it took 4 years for that piece of AI to defeat Brad Rutter and Ken Jennings in 2011. And that’s very specific to Jeopardy! and does not apply outside that domain. No need to worry about the Terminators, yet.

#3 When AI gets boring, it gets productive

Think about how mind-blowing innovations, like jet engines, operate in the background. For centuries human beings dreamed about flying. But today we take it for granted that we fly to New York for the day and be back in Toronto for dinner.

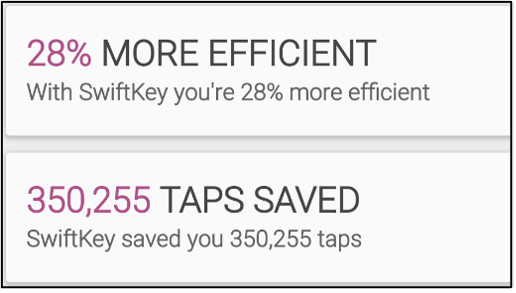

Similarly, when don't think about AI already operating in the background. Consider the AI-enabled voice or keyboards on your smartphone. We don't think of such advances that it has enabled because it is already ubiquitous. For me switching from Blackberry to Android, was an AI-enabled keyboard that helped transition from the physical keyboard to the touch keyboard that has now come to dominate smartphones. This turned out to be a boon in productivity:

In other words, this is what AI really looks like: boring as a daytrip on a plane to New York.

#4 Keep your eye on GPT-3

One up-and-coming AI-enabled service to watch is GPT-3 from an organization called OpenAI. OpenAI was started by Elon Musk (but since has left). It’s in beta right now and in a raw state but the capabilities that have surfaced are pretty amazing.

One capability (as noted in this video) it has is summarizing long reads. However, there are serious flaws that need to be worked out. For example, it advised a fake patient suffering from depression to kill themselves. So, it's not going to be rolled out at a hospital any time soon, but it is something definitely to watch.

#5 AI and CPAs: Competitors or Collaborators?

AI could make the profession more sustainable, as these mundane tasks could be handed to a system. MIT’s Eric Brynjolfsson describes this concept as "race with the machine". The idea is that doctors, accountants, lawyers, can work better together with technology. It’s almost like a second set of eyes or someone that can help you assess whether the professional judgement on an issue is correct. (See Further Reading, to see more on Brynjolfsson ideas on the topic.)

However, this is not something that is currently on the horizon.

What’s more realistic is understanding where the economics of automation will apply for more basic things like have a timelier closing of the financial books for year-end. McKinsey put out a study in August 2020 that found automating and increasing the accuracy of forecasts helped management make better decisions. One case study they highlighted was a manufacturer that was able to reduce inventories and product obsolescence by 20 to 40 percent.

Further reading

Beyond the McKinsey article cited earlier, here are 3 additional resources:

A CPA's introduction to AI: From algorithms to deep learning by CPA Canada

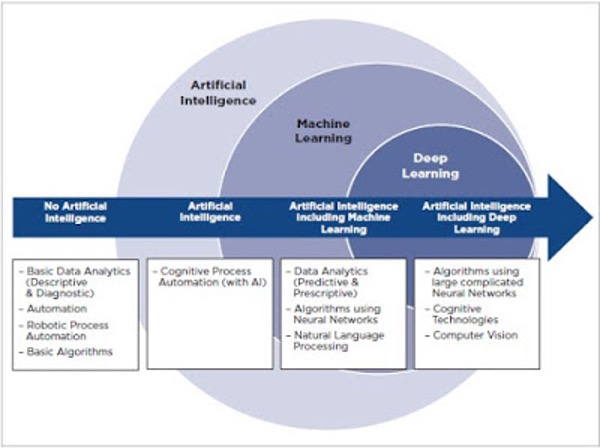

Full disclosures, I was a part of the Committee that was involved with the review and editing of the document. That being said, it is specifically written for the CPAs in mind as opposed to computer scientists. For example, the publication provides not only a Glossary of Terms (e.g. what's the difference between machine learning and deep learning). Also, like how the publication uses the following maturity to explain the technology as a continuum of data processing and analysis technologies:

Rise of the Robots by Martin Ford

For those more interested in an understanding on the potential economic impact of artificial intelligence, Martin Ford's Rise of the Robots. The book explores the underlying realities of how technological efficiency could result in economic displacement. That being said, it does need to be updated. For example, Watson Health (the IBM's follow-up to the Jeopardy! champion) did not pan out as expected. It goes back to the reality that AI is just a system and not magic. With that in mind, the book does provide a good summary of the economics around the topic.

The Second Machine Age by Erik Brynjolfsson and Andrew McAfee

For an alternative perspective, The Second Machine age by Erik Brynjolfsson and Andrew McAfee looks at the potential from a "general purpose technology" that future economic value can be built on. In a sense, it goes back to the idea of jet engines and how that technology has enabled day trips from Toronto to New York.

In a Ted Talk, Brynjolfsson’s coined the concept of "race with the machine" to describe how AI can make the profession more sustainable, as these mundane tasks could be handled by AI. The idea is that doctors, accountants, lawyers, can work better together with technology. It’s almost like a second set of eyes or someone that can help you assess whether the professional judgement on an issue is correct. In fact, one of the doctors who worked with AI in health was disappointed that the technology did not provide this type of collaboration.

In closing, we should be aware of the concept of exponential change. Technology, like AI, improves at an exponential rate and not a linear rate. Consequently, monitoring the space is key for CPAs in order to adapt to the changes before others.

Author: Malik Datardina, CPA, CA, CISA. Malik is a GRC Strategist at Auvenir. Auvenir is working to transform the engagement experience for accounting firms and their clients. The opinions expressed here do not necessarily represent those of Auvenir